- 2023-02-21

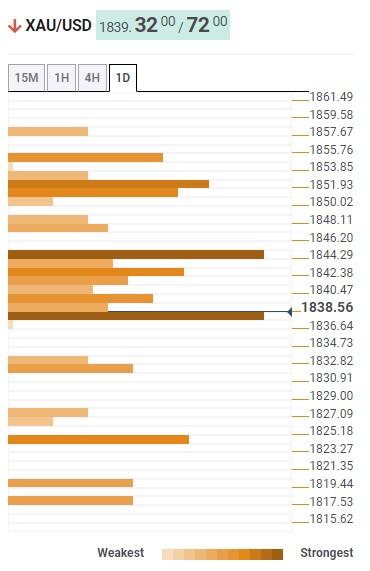

Gold Price Forecast: XAU-USD bears keep the reins below $1845 – Confluence Detector

Gold price (XAU/USD) retreats towards the previous weekly low also the lowest since late December as risk aversion joins the return of full markets to underpin the US Dollar. Adding strength to the greenback as well as weighing on the XAU/USD could be the upbeat US Treasury bond yields. That said geopolitical fears surrounding China and Russia seem to propel the latest rush toward risk safety. On the same line are fresh concerns over the Federal Reserves (Fed) hawkish move following the strong US data. Its worth noting however that the cautious mood ahead of the preliminary readings of the US Purchasing Managers Index (PMI) data for February seems to challenge the Gold price. Also important is Wednesdays Federal Open Market Committees (FOMC) Monetary Policy Meeting Minutes. In addition to the cautious mood and fears of higher Fed rate technical confluence also keeps Gold bears hopeful. Also read: Gold Price Forecast: XAU/USD sellers lurk at $1850 downside remains favored Gold Price: Key levels to watch The Technical Confluence Detector shows that the Gold price attacks the short-term key support near $1837 comprising Pivot Point one day S1 50-HMA and previous lows on the four-hour one-hour and one-day. That said the metals latest weakness could be linked to the pullback from another key technical level namely $1845 that comprises Fibonacci 61.8% one-day previous high on four-hour and the upper Bollinger on 15-minutes. Also acting as a short-term important resistance is the 200-HMA Pivot Point one-day R2 and Pivot Point one-month S1 close to $1852. Meanwhile the Gold price weakness below the immediate $1837 support has an open space towards the south unless hitting the previous monthly low surrounding $1825. Following that the previous weekly low and Pivot Point one week S1 could entertain the XAU/USD bears around $1819-17 before highlighting the $1800 threshold. About Technical Confluences Detector The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators moving averages Fibonacci levels Pivot Points etc. If you are a short-term trader you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest where to unwind positions or where to increase your position size.

.jpg)

.jpg)

.jpg)

.jpg)